Introduction

Compliance management has become a cornerstone of operational strategy in organizations globally. As regulatory landscapes continue to evolve, particularly in the Asia-Pacific (APAC) region and globally, companies find themselves navigating a maze characterized by an ever-increasing complexity of regulations. As regulators introduce more granular control expectations and expand the perimeter of oversight. Firms are now grappling with overlapping global obligations, shifting regulatory expectations, and a more punitive enforcement landscape.

In this increasingly interconnected world, the future of compliance management must be integrated, streamlined, and technologically advanced.

In 2024, global enforcement surpassed $19 billion, with a substantial portion linked to compliance control failures. Over the next five years, emerging regulations are set to introduce even greater demands for compliance teams, requiring tighter controls and a continuous focus on evolving risks and advancing technology.

Despite ongoing pressures, numerous organizations continue to depend on legacy, compartmentalized compliance processes, thereby increasing their vulnerability to non-compliance risks. Comprehensive data integration is frequently perceived as either overly complex or excessively costly, whether stemming from technological limitations or the mistaken belief that modernization necessitates an extensive, expensive transformation.

Key Regulatory Trends in APAC

1. Stronger AML / KYC / Financial Crime Rules

Regulators are tightening anti-money laundering (AML) and know-your-customer (KYC) rules. For example, Singapore has enhanced AML requirements for digital payment providers

2. Data Privacy, Localization, and Cybersecurity

New and/or strengthening data protection laws. E.g., Indonesia’s Personal Data Protection Act; India’s data privacy law developments.

3. Governance, Disclosure & Corporate Responsibility

Increased expectations by regulators for more transparency, better corporate governance globally (especially for listed companies), disclosure of risk, environmental/social governance (ESG) issues.

4. AI / Advanced Tech Regulation

APAC countries are rapidly establishing frameworks for AI ethics and digital regulation, with landmark policies like Malaysia’s National Cloud Computing Policy leading the way.

5. Regulatory Technology (RegTech) & Compliance Automation

Companies and regulators globally are investing more in tools to automate compliance (AML, KYC, transaction monitoring etc.), use of AI/ML to predict risk, continuous compliance rather than periodic checks.

6. Regulation of Digital Assets / Crypto

Licensing regimes for crypto (Hong Kong, Japan etc.), stronger oversight of virtual currency exchanges.

Some countries are taking a more cautious stance on stablecoins and tokenization; India, for instance, remains reserved.

Top emerging / recent regulatory priorities in APAC

Here’s a focused look at recent regulatory shifts across key APAC markets:

- India:

- Digital Personal Data Protection Act (DPDPA): India’s long-awaited data privacy law mandates strict consent management and data localization considerations.

- Business Responsibility & Sustainability Report (BRSR): Mandatory, detailed ESG disclosures for top listed companies, pushing sustainability into the core compliance agenda.

- Singapore:

- MAS Environmental Risk Guidelines: The central bank expects financial institutions to formally integrate climate risk into their governance and credit assessment processes.

- Enhanced PDPA Enforcement: Stricter enforcement and amendments around data breach notification and deemed consent are raising the bar for accountability.

- Malaysia:

- Section 17A, MACC Act: Corporate liability for corruption, with the only defense being proof of “adequate procedures” across the organization and its third parties.

- Climate Change Taxonomy: A principles-based framework guiding financial institutions in classifying green activities, a precursor to mandatory climate reporting.

- Thailand:

- Personal Data Protection Act (PDPA): Full enforcement of this GDPR-style law is underway, with significant compliance burdens around data processing and cross-border transfers.

- Supply Chain Scrutiny: Growing regulatory and investor pressure for ethical supply chain due diligence, particularly in manufacturing and agriculture.

- Philippines:

- Data Privacy Act Vigilance: The National Privacy Commission is actively enforcing robust data security measures and breach notification protocols.

- Financial Consumer Protection (FCP): Stringent BSP regulations demand transparency and fair treatment at every customer touchpoint, blending compliance with customer experience.

The frameworks referenced below codify mandatory controls, clarifying expectations and reducing regulatory uncertainty. Ensuring alignment with regulatory expectations is a necessary challenge, and demonstrating rationale with a bulletproof audit trail is non-negotiable.

| Country | Key Regulations | Controls | Review Frequency | Departmental Ownership |

|---|---|---|---|---|

| India | – Digital Personal Data Protection Act (DPDPA) 2023 – RBI Cybersecurity Framework – SEBI Risk-Based Supervision – ESG Reporting (BRSR Core) | – Data Processing Inventory – Consent Management Logs – RBI Incident Response Records – SEBI Governance & Control Declarations – ESG Performance Metrics | Quarterly / Annual | Risk & Compliance / IT / ESG Office |

| Singapore | – MAS TRM Guidelines (2024 Update) – PDPA Amendments – ESG Disclosure Mandates – Cybersecurity Act 2024 | – TRM Gap Assessment Report – Data Breach Notification Logs – ESG Disclosure Audit Trail – Third-Party Risk Evaluation | Semi-Annual | Compliance / IT Security / Sustainability |

| Malaysia | – Bank Negara RMiT Guidelines – Personal Data Protection Act (PDPA) – MCCG (Corporate Governance) – Bursa Malaysia ESG Mandate | – Risk Register aligned to RMiT – Vendor Assessment Reports – PDPA Data Handling SOP – ESG Reporting Evidence | Annual | Risk Management / Governance / ESG |

| Thailand | – PDPA (Thailand) – Bank of Thailand IT Risk Guidelines – SEC ESG Disclosure Framework | – Data Mapping Sheets – IT Risk Control Evidence – ESG Assurance Documents | Annual | Data Protection Officer / Risk / ESG |

| Philippines | – Data Privacy Act (NPC) – BSP Circular No.1140 on Operational Resilience – SEC Sustainability Reporting | Data Privacy Impact Assessments – Cyber Resilience Audit Logs – Sustainability Data Pack | Annual | IT / Compliance / Sustainability |

Top-3 Focus Areas Grouping (2025):

| Focus Area | High-Risk Countries | Control Review Emphasis | Reporting Priority |

|---|---|---|---|

| Data Protection & Privacy | India, Singapore, Thailand, Philippines | Consent tracking, data mapping, breach readiness | Board-level quarterly update |

| Operational & IT Resilience | Malaysia, Singapore, Philippines | IT risk governance, incident response, third-party continuity | Executive audit committee review |

| ESG & Corporate Governance | India, Malaysia, Thailand | ESG data accuracy, climate reporting, governance disclosures | Annual sustainability & compliance report |

Regulatory Overlap: Escalating the Compliance Challenge in APAC

Navigating the APAC regulatory landscape is no longer just about complying with individual rules, but with a tangled web of overlapping obligations. A single business activity can trigger multiple, simultaneous compliance requirements across different regulatory domains. For instance, a data breach not only violates data privacy laws like India’s DPDPA or Thailand’s PDPA but can also become a mandatory ESG disclosure under frameworks like India’s BRSR, as it impacts corporate governance and social responsibility.

Similarly, a corruption incident with a third-party supplier doesn’t just breach anti-bribery laws like Malaysia’s Section 17A; it can also violate sustainable finance principles under Malaysia’s climate taxonomy and break supply chain due diligence expectations in countries like Thailand. In India, the Digital Personal Data Protection Act (DPDPA) intersects with RBI’s Cybersecurity Framework, forcing companies to reconcile data privacy governance with stringent IT risk management expectations, a financial institution in Singapore must simultaneously comply with the MAS Technology Risk Management (TRM) Guidelines and the Cybersecurity Act 2024—both addressing resilience, but demanding separate reporting structures and control validations.

This convergence means that a failure in one area can cause a domino effect of non-compliance across others, dramatically amplifying the risk and underscoring the critical need for an integrated, holistic compliance strategy.

Recent Examples of Compliance Failure:

SAP SE (2024): SAP agreed to pay over US$220 million to settle FCPA violations involving bribery schemes in several APAC countries, including Indonesia. The case highlighted failures in third-party vetting and monitoring off-channel communications, such as WhatsApp, which regulators now scrutinize closely.

Legacy Compliance: An Obstacle to Future Resilience

Many organizations are riding on the laurels of legacy compliance program systems built on spreadsheets, point solutions, and siloed processes that have, until now, “gotten the job done.” This fragmented approach, however, has reached its breaking point. Managing tomorrow’s interwoven regulatory web with yesterday’s disconnected tools creates critical blind spots. True resilience doesn’t come from merely adding another control to the pile; it comes from integrated intelligence. Relying on a patchwork of fixes is a strategic risk. The future belongs to those who replace reactive, checkbox compliance with a unified, proactive view of risk and obligation.

Future-Ready Compliance Strategy: From Reaction to Resilience

To thrive in this era of accelerating regulatory change, organizations must evolve from reactive compliance management to proactive resilience building. The key lies in convergence—unifying risk, control, audit, and ESG functions within a single governance framework. By leveraging intelligent automation, real-time monitoring, and data-driven insights, firms can not only ensure continuous compliance but also transform regulatory obligations into strategic advantage. The future of compliance belongs to those who view control not as a checkbox, but as a dynamic enabler of trust, transparency, and long-term organizational integrity.

“Past Performance Does Not Guarantee Future Success”

The Case for an Integrated Framework

An integrated compliance framework serves as the backbone of a resilient organization. Instead of treating risk, compliance, audit, and ESG as isolated functions, it unites them under a shared governance structure supported by a single source of truth. This approach eliminates duplication, enhances data consistency, and provides leadership with a 360-degree view of enterprise risk posture. By embedding automation, analytics, and standardized control taxonomies, an integrated framework transforms compliance from a reactive cost center into a proactive driver of business performance, accountability, and strategic decision-making.

But what does it mean to have an integrated compliance framework?

Compliance, ethics, and risk are inherently linked and must be managed in a way that reflects this interdependence. An integrated framework centralizes compliance management, ensuring consistency across all levels of the business.

Future requirements demand embedded compliance across processes, products, services, people, and technology, ensuring alignment with both internal policies and external rules. A truly integrated framework extends beyond documentation, enabling end-to-end compliance by linking policies, controls, and risk management to operational elements such as testing, attestations, and audits.

Adapting for the future of compliance management

| Current Approach | Compliance Risk | What’s Needed |

|---|---|---|

| Manual data entry and spreadsheet-based compliance tracking | High likelihood of human error, version conflicts, and data integrity issues | Automated, system-driven compliance management with centralized dashboards and real-time validation |

| Siloed compliance and risk functions operating independently | Gaps in accountability and duplication of controls across departments | Integrated GRC framework that unifies risk, audit, compliance, and ESG into a single governance model |

| Periodic control assessments (e.g., annual audits) | Limited visibility between reviews; delayed detection of control failures | Continuous control monitoring with automated alerts and analytics-driven insights |

| Regulation-by-regulation compliance updates | Overlapping requirements create inefficiencies and missed interdependencies | Cross-regulatory harmonization leveraging a shared control library and regulatory mapping |

| Legacy systems with static workflows | Inflexibility to adapt to new mandates such as data privacy or ESG reporting | Agile, configurable platforms that enable quick adaptation and scalability as regulations evolve |

| Ad-hoc third-party/vendor compliance tracking | Poor oversight of outsourcing risks, lack of evidence for regulatory reviews, potential fines | Centralized vendor risk management with automated monitoring, contractual compliance tracking, and integrated third-party audit workflows |

The Future of Compliance Management is Integrated

Your Route to Integration

Achieving an integrated compliance and risk framework requires a deliberate, phased approach. Start by mapping all existing processes, controls, and regulatory obligations to identify overlaps and gaps. Next, centralize control data within a unified platform that supports automated monitoring, reporting, and analytics. Standardize control taxonomies and embed real-time dashboards for management oversight. Prioritize cross-functional alignment among risk, compliance, audit, and ESG teams to foster collaboration and shared accountability. By following this route to integration, organizations can transform compliance from a reactive obligation into a strategic advantage, enabling resilience, transparency, and informed decision-making across the enterprise.

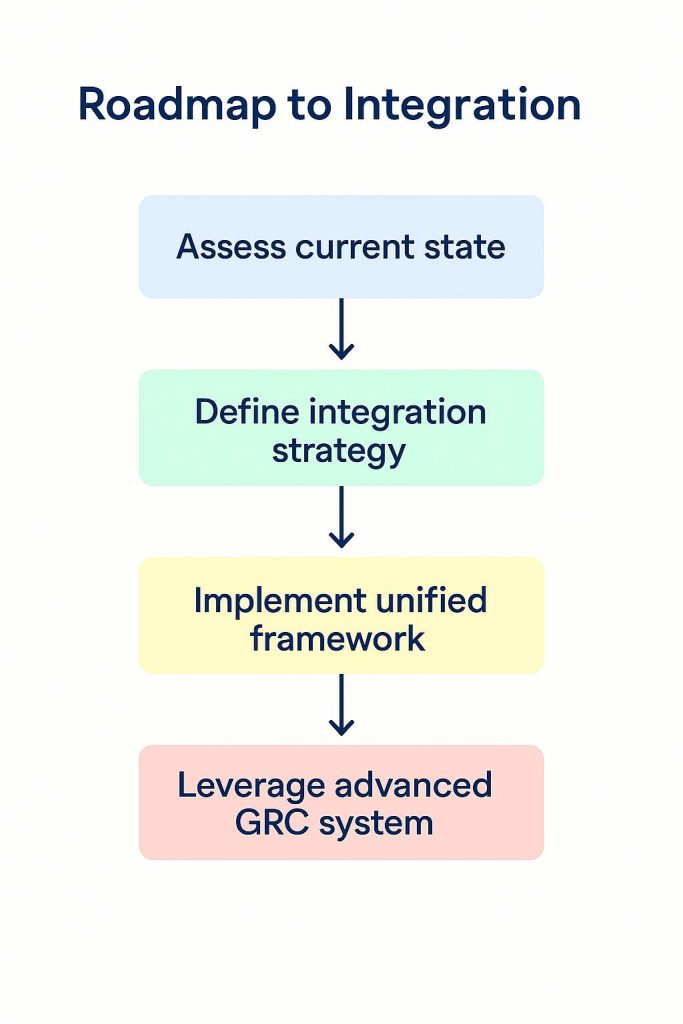

Roadmap to Integration

A successful roadmap to integration begins with a comprehensive assessment of the current compliance landscape, identifying redundancies, gaps, and fragmented processes. The next step is to design a unified GRC architecture that connects risk, compliance, audit, and ESG functions while embedding automation and real-time monitoring.

A successful roadmap to integration begins with a comprehensive assessment of the current compliance landscape, identifying redundancies, gaps, and fragmented processes. The next step is to design a unified GRC architecture that connects risk, compliance, audit, and ESG functions while embedding automation and real-time monitoring.

Leveraging advanced GRC technology is essential to streamline workflows, centralize data, and enable predictive insights for regulatory compliance. Organizations should implement phased adoption, starting with high-priority regulatory areas and gradually incorporating additional domains. Continuous training, change management, and stakeholder engagement are critical to ensure adoption and sustainment. Finally, periodic review and iterative improvements will keep the integrated framework agile, enabling proactive compliance management and a strategic edge in an evolving regulatory environment.

Integrated Compliance within a GRC Platform

Once compliance processes are digitized, the next step is achieving a unified view across systems. Many firms, particularly those that adopted point solutions for specific compliance needs, now find themselves managing a fragmented ecosystem of tools, each handling a different function in isolation. True compliance maturity comes from integration; consolidating data flows to create a centralized compliance intelligence layer.

- Consolidate Your Data: Whether compliance tools come from a single provider or a mix of best-in-class solutions, modern GRC platforms serve as an orchestration layer, pulling data from various compliance modules—including third-party applications—into a centralized compliance architecture.

- Gain Visibility: Compliance teams often struggle with siloed visibility, where policies, risks, control testing, and attestations exist in separate systems. Integrated dashboards bridge this gap, offering a single source of truth that consolidates risk metrics, control effectiveness, policy adherence, and training status into one real-time interface.

- Analyze Your Data: With compliance data unified in a single dashboard, firms gain a comprehensive, real-time view of their risk and control environment. This single source of truth eliminates fragmented reporting and enables deeper analysis—allowing compliance teams to identify trends, uncover hidden risks, and make data-driven decisions with confidence. With structured data at their fingertips, firms can move beyond static reporting toward more dynamic analytics, scenario modeling, and continuous improvement.

How GRC Partners Asia Supports Compliance Excellence

As regulatory landscapes in APAC and globally become increasingly complex—with overlapping obligations, divergent standards, and stricter enforcement—organizations require a proactive, integrated approach to compliance. GRCPA helps companies navigate this complexity by providing technology-enabled, holistic governance, risk, and compliance (GRC) solutions.